Your UI tax rate is calculated for your individual business on a yearly basis. We normally send it to you in December. It applies to taxable wages you pay to your employees the following calendar year. You will either receive a new employer rate or an experience rate, depending how long you have been paying wages.

- New employers: Employers that pay wages for two years or less are assigned a tax rate based on the average for their industry.

- Experience-rated employers: Employers that pay wages for more than two years will be experience-rated. Their business specific tax rate is determined based on:

- Wages paid to their employees

- Unemployment benefits paid to their employees

Your UI tax bill includes your initial amount due, plus any assessments due.

Your initial amount due

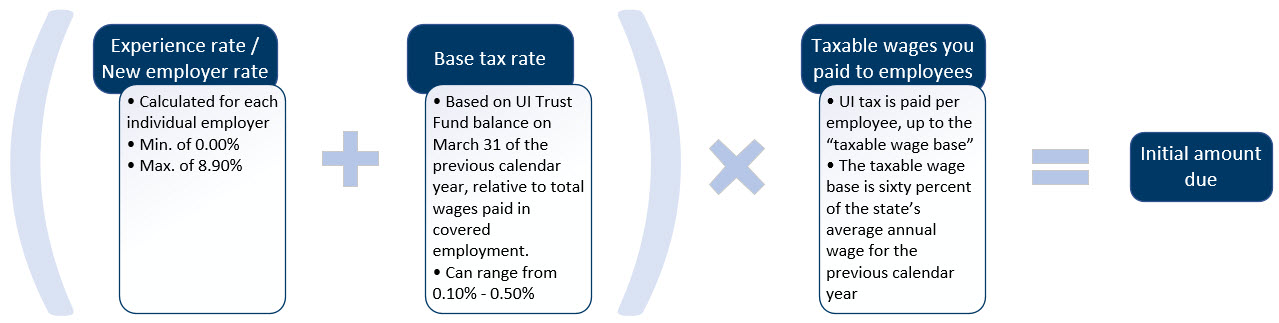

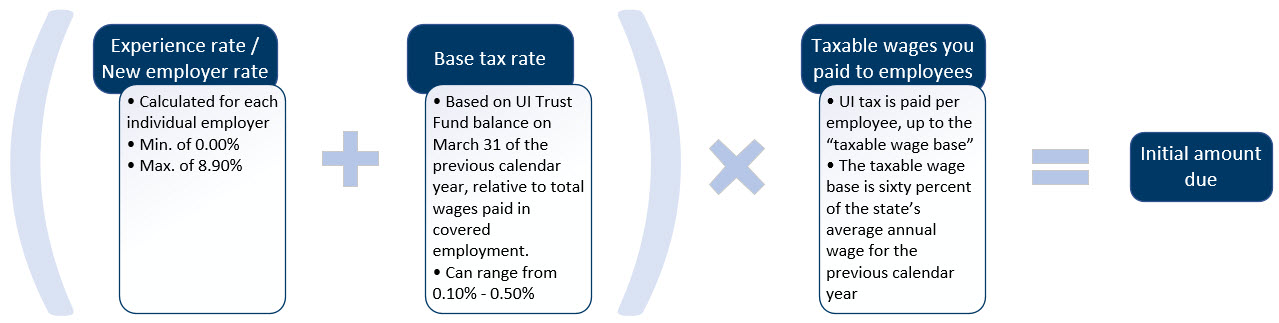

We calculate your initial amount due using three elements.

Taxable wages: Wages you pay to a covered employee are taxable, up to the taxable wage base. The taxable wage base is sixty percent of the state’s average annual wage for the previous calendar year.

- The taxable wage base is the maximum amount of an employee’s wages that will be subject to unemployment insurance tax during a tax year (January through December).

- The taxable wage base is indexed to the state’s average wage. It can change every year. It is included on your annual Unemployment Insurance (UI) Tax Rate Determination.

- The taxable wage base for 2024 is $42,000.

- That means you are only taxed for the first $42,000 in wages you pay to each employee, each year.

- You must report all the wages you pay to a covered employee. We will then determine the portion of the wages that are taxable.

- You may notice that your UI tax bill is higher in the early part of the year. This is because the wages you pay to employees later in the year may exceed the taxable wage base.

Experience rate: varies per employer.

- Your experience rate is a ratio of benefits paid to your employees to the taxable wages you paid all your employees for the same period of time.

- Employers who are new to unemployment insurance are assigned a “new employer rate” instead of an experience rate. The new employer rate is based on the average experience rate of employers in your industry.

- After you’ve paid wages in covered employment for more than two years, you will get an individually calculated experience rate.

- In 2024, the experience rating period is July 1, 2019 through June 30, 2023.

- Once you are experience rated, you get a recalculated experience rate every year.

- The general idea is that employers who have more unemployment will get a higher experience rate.

- The minimum experience rate is 0.00%.

- The maximum experience rate is 8.90%.

Base tax rate: The base tax rate is calculated annually and is the same for all employers.

- The base tax rate for 2024 is 0.10%.

- The base tax rate is based on the balance in the UI Trust Fund on March 31 of the previous calendar year, relative to total wages paid in covered employment.

- The base tax rate goes up when the balance in the UI Trust Fund declines.

- The minimum base tax rate is 0.10%.

- The maximum base tax rate is 0.50%.

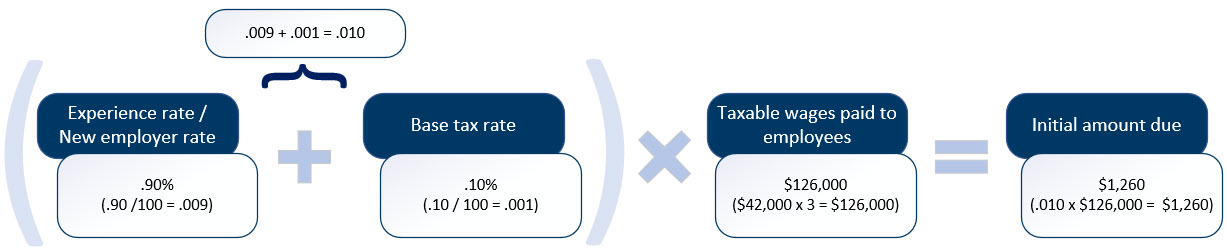

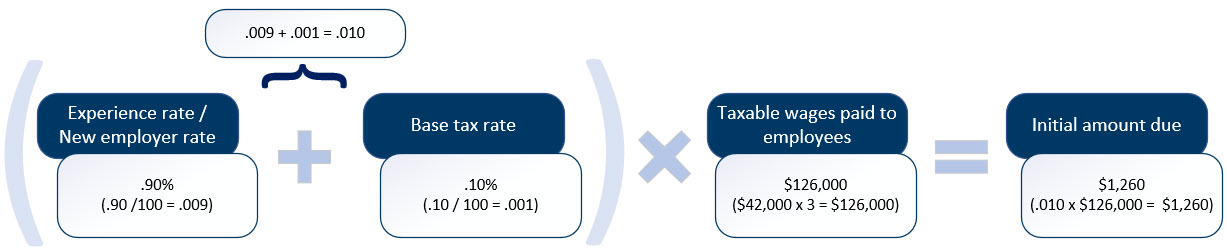

As an example, consider this hypothetical employer:

- Paid $150,000 in total wages for the year ($50,000 x 3 employees)

- Had a UI experience rate of 0.90%*

- The UI base tax rate for the year was 0.10%*

- The UI taxable wage base for the year was $42,000

To calculate: Add your Experience rate / New employer rate and Base tax rate together (.90% + .10% = 1.00%). Next, multiply the Taxable wage amount ($42,000 x 3 employees = $126,000) by the calculated decimal amount* (.010) to get your Initial amount due of $1,260 ($126,000 x .010 = $1,260).

*To convert the percentage amount to a decimal, remove the percent sign and then divide by 100. Example: 1.00% converted to a decimal is .010 (1.00 divided by 100 equals .010).

Unemployment Insurance assessment

In addition to quarterly taxes, employers pay assessments to replenish the UI Trust Fund, cover the interest costs for borrowed federal funds, and support jobs and training initiatives.

After your quarterly amount due is calculated, we use the initial amount due to calculate any UI assessments due. There are two different UI assessments:

- Additional Assessment: The additional assessment is triggered on when the UI Trust Fund falls below a certain level as of a certain date.

- There is no additional assessment for calendar year 2024.

- Special Assessment (Federal Loan Interest Assessment): Unemployment benefits are paid from the Unemployment Insurance (UI) Trust Fund. When the trust fund is depleted because of high payouts - usually during a recession - the state borrows money from the federal government. States must pay interest on these borrowed funds. The Special Assessment is used to pay the interest on the loan.

- There is no Special assessment for calendar year 2024.