Your UI tax rate is calculated for your individual business on a yearly basis. We send it to you in December. It applies to taxable wages you pay to your employees the following calendar year. You will either receive a new employer rate or an experience rate, depending how long you have been paying wages.

- New employers: Employers that pay wages for two years or less are assigned a tax rate based on the average for their industry.

- Experience-rated employers: Employers that pay wages for more than two years will be experience-rated. Their experience rate is based on:

- Wages paid to their employees during the four-year experience rating period.

- Unemployment benefits paid to their employees during the four-year experience rating period.

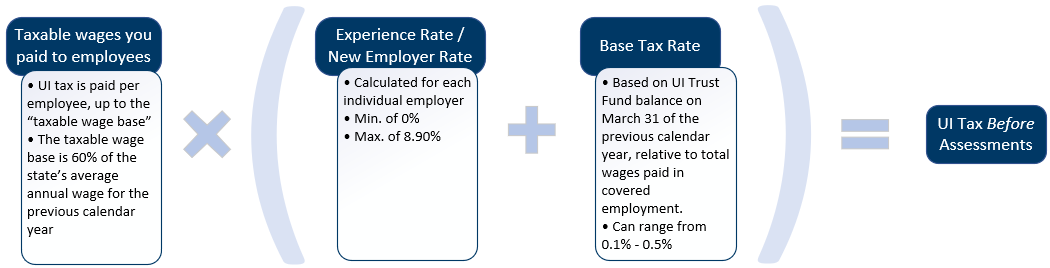

Your UI tax bill includes your UI Tax Before Assessments , plus any UI Assessments due.

Your UI Tax Before Assessments

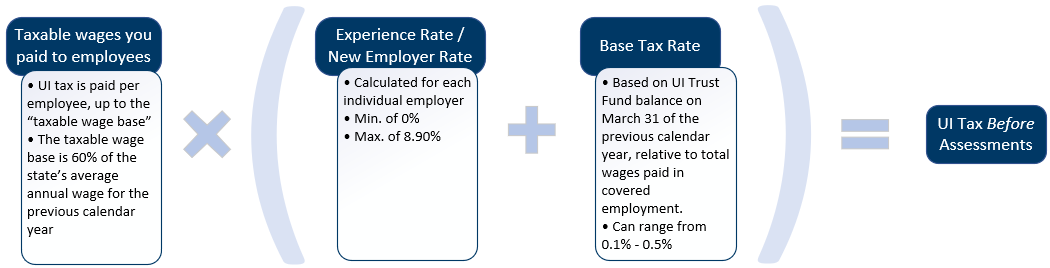

We calculate your UI Tax Before Assessments using three elements.

Taxable wages: Wages you pay to a covered employee are taxable, up to the taxable wage base. The taxable wage base is sixty percent of the state’s average annual wage for the previous calendar year.

- The taxable wage base is the maximum amount of an employee’s wages that will be subject to unemployment insurance tax during a tax year (January through December).

- The taxable wage base is indexed to the state’s average wage. It can change every year. It is included on your annual Unemployment Insurance (UI) Tax Rate Determination.

- The taxable wage base for 2026 is $44,000.

- That means you are only taxed for the first $44,000 in wages you pay to each employee in 2026.

- You must report all the wages you pay to a covered employee. We will then determine the portion of the wages that are taxable.

Experience rate: varies per employer.

- Your experience rate is a ratio of benefits paid to your employees to the taxable wages you paid all your employees for the same period of time.

- Employers who are new to unemployment insurance are assigned a “new employer rate” instead of an experience rate. The new employer rate is based on the average experience rate of employers in your industry.

- After you’ve paid wages in covered employment for more than two years, you will get an individually calculated experience rate.

- For UI tax year 2026, the experience rating period is July 1, 2021 through June 30, 2025.

- Once you are experience rated, you will get a new, individually calculated, experience rate for each tax year.

- The general idea is that employers who have more unemployment will get a higher experience rate.

- The minimum experience rate is 0.00%.

- The maximum experience rate is 8.90%.

Base tax rate: The base tax rate is calculated annually and is the same for all employers.

- The base tax rate for 2026 is 0.40%.

- The base tax rate is based on the balance in the UI Trust Fund on March 31 of the previous calendar year, relative to total wages paid in covered employment.

- The base tax rate goes up when the balance in the UI Trust Fund declines relative to total wages paid in the state.

- The minimum base tax rate is 0.10%.

- The maximum base tax rate is 0.50%.

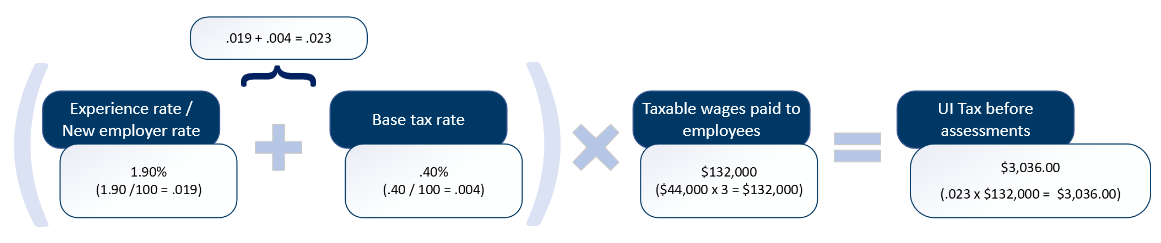

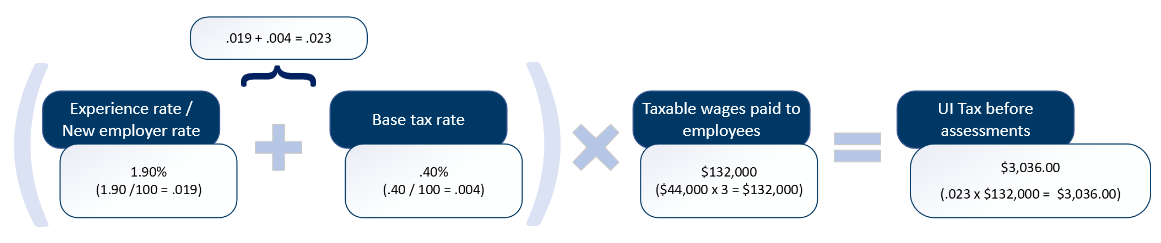

As an example, consider this hypothetical employer:

- Paid $150,000 in total wages for the year ($50,000/employee x 3 employees)

- Had a new employer rate of 1.90%*

- The UI base tax rate for the year was 0.40%*

- The UI taxable wage base for the year was $44,000 (for each employee, the first $44,000 of the $50,000 in wages they earned is taxable. The remaining $6,000 per employee would not be taxed.)

To calculate UI Tax Before Assessments:

- Add the employer's New employer/Experience rate and the Base tax rate together (1.90% + .40% = 2.30%).

- Convert the sum of the two rates (2.30%) from a percentage amount to a decimal amount (2.30 / 100 = .023).

- Multiply the Taxable wage amount ($44,000 x 3 employees = $132,000) by the calculated decimal amount* (.023) to get your UI Tax Before Assessments of $3,036 ($132,000 x .023 = $3,036).

*To convert the percentage amount to a decimal, remove the percent sign and then divide by 100. Example: 1.00% converted to a decimal is .010 (1.00 divided by 100 equals .010).

Unemployment Insurance assessment

After your UI Tax Before Assessments is calculated, we then calculate and add any UI assessments. There are potentially two different UI assessments:

- Additional Assessment: The additional assessment is triggered on when the UI Trust Fund falls below a certain level as of a certain date.

- The additional assessment for 2026 is 14.00%.

- The additional assessment can range between 0.00% – 14.00%.

- Special Assessment (Federal Loan Interest Assessment): Unemployment benefits are paid from the Unemployment Insurance (UI) Trust Fund. When the trust fund is depleted because of high payouts - usually during a recession - the state borrows money from the federal government. States must pay interest on these borrowed funds. The Special Assessment is used to pay the interest on the loan.

- There is no Special Assessment for calendar year 2026.

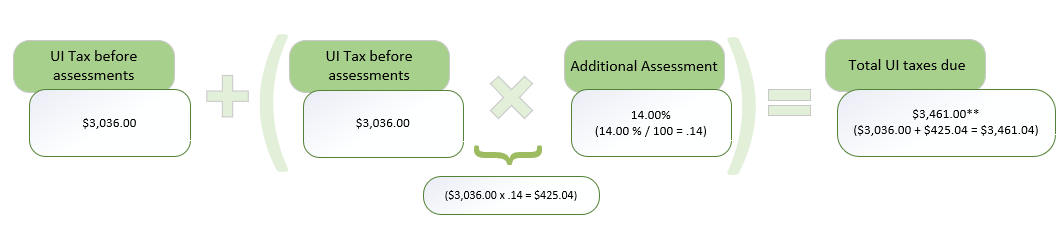

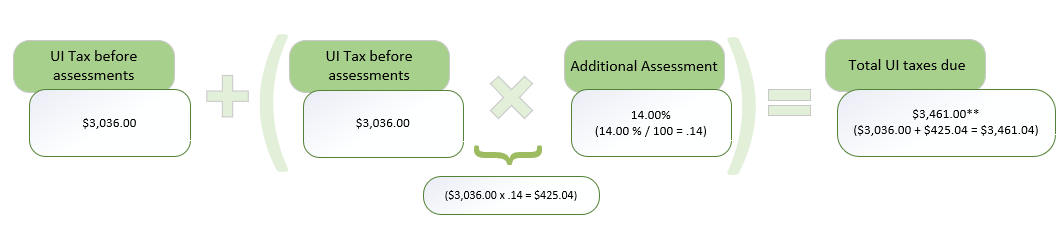

In the example above, the employer’s UI Tax Before Assessments was $3,036 and the Additional Assessment for the year was 14.00%.

To calculate the Total UI taxes due:

- Convert the Additional Assessment percentage rate (14.00%) to a decimal (14.00 / 100 = .14).

- Multiply the UI Tax Before Assessments by the Additional Assessment rate ($3,036.00 x .14 = $425.04).

- Add the UI Tax Before Assessments to the Additional Assessment ($3,036.00 + $425.04 = $3,461.04) to reach your Total UI taxes due of $3,461.00**).

**The Total UI Taxes Due amount will be rounded down (truncated) to the next whole dollar if the amount is not a whole dollar. Rounding occurs after the calculation (not at the employee record).