Understanding your employer accounts

Wage detail reports

If you have employees who are covered by Unemployment Insurance (UI) OR Paid Leave, you must report their gross wages every quarter.

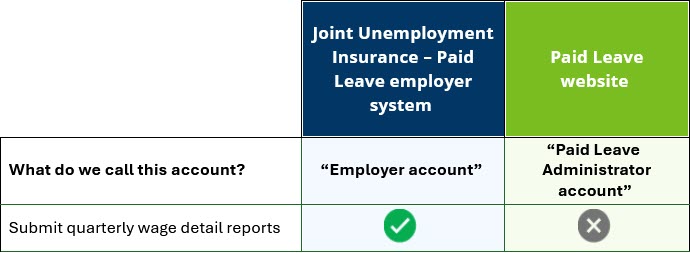

Submit quarterly wage detail reports

The process for submitting quarterly wage detail reports varies slightly depending on the type of employees you have. Refer to our Understanding employer account types page for more information on different employer account types.

- If ALL your employees are covered by both UI and Paid Leave: you will provide a single wage detail submission using your Joint UI - Paid Leave employer account. Most employers in Minnesota will use this option.

- If SOME of your employees are covered by both UI and Paid Leave, but some employees are covered ONLY by Paid Leave: you will provide two wage detail submissions - one using your Joint UI - Paid Leave employer account, the other using your Paid-Leave-ONLY employer account.

- If your employees are ONLY covered ONLY by Paid Leave, not by UI: you will provide a single wage detail submission using your Paid-Leave-ONLY employer account.

Read more about wage detail reporting requirements and wage detail due dates.